News companies need a new playbook to navigate advertising disruptions

Advertising Initiative Blog | 03 September 2025

As the news media industry continues facing disruption, news publishers are changing how they approach every aspect of operations.

From declining advertising revenues and opaque programmatic systems to the rise of outcome-based measurement and AI-driven operations, this week’s INMA Webinar, From disruption to domination: the new ad playbook for news media, offered a strategic framework for publishers to adapt and thrive.

INMA CEO Earl Wilkinson and Advertising Initiative Lead Gabriel Dorosz examined the growing challenges facing the industry. The Webinar grew out of Dorosz’s presentation at the recent INMA CEO Roundtable in Napa Valley, California, and answered some of the questions that arose from that event, Wilkinson explained.

“We are living through arguably the most transformative moment in media advertising and technology in the history of the world,” Dorosz said. “No one knows exactly what the future holds. So the only strategy is to identify where you can win in the near to midterm — and iterate forward.”

Doing that, he explained, requires a great deal of change management. Leaders must attempt to predict the future without getting too grounded in certainty, “because change is the only certainty of the next three to five years and beyond.”

The new advertising ecosystem

Dorosz presented a visual breakdown of the digital advertising ecosystem, illustrating just how complex it has become. Between advertisers and publishers lies a complex web of intermediaries, including supply-side platforms (SSPs), demand-side platforms (DSPs), exchanges, and data vendors all taking a cut of the revenue.

According to a recent study by the Association of National Advertisers (ANA), publishers receive only 41 cents of every dollar spent programmatically. The rest is absorbed by adtech middlemen.

“This is a big challenge,” Dorosz said. “Most publishers don’t feel like the current adtech and programmatic ecosystem is working well.”

That’s increasing the demand for alternatives including private programmatic deals, he noted.

Publishers should also consider the growing number of collaborative opportunities and models, Dorosz said: “You’re seeing smaller publishers band together to tackle these challenges collectively.”

Sometimes these opportunities involve bundling inventory together, and sometimes they include bundling resources together. Dorosz stressed the need for news publishers — particularly smaller ones — to share more information, work together, and consider forming such alliances.

AI’s expanding role in ad operations

Not surprisingly, AI emerged as a key theme during the Webinar, and Dorosz pointed to its potential to streamline and enhance ad operations.

In the short term, “We should be looking at ways to use AI and automation to solve low-hanging fruit,” he said. “A good example of that is make-goods.”

In the midterm, the answer appears to be leading toward automated campaigns. In the next one to three years, he expects to see automated end-to-end campaign operations that begin with a self-service portal and generate creative content automatically.

From there, the campaign “is trafficked, optimised, managed, and then performance alerts trigger sort of changes, changes to the campaign itself, and reporting is automated and delivered to the client and applied to future campaigns.”

Wilkinson added that publishers must rethink their staffing models to support this evolution, noting “feet on the street” are no longer enough: “You need more ad tech people [and] technology people on our teams.”

Measuring what matters

One of the significant changes facing the industry is the shift in how advertising success is measured. Traditional metrics like reach and impressions are no longer sufficient. Advertisers are increasingly focused on outcomes, which “isn’t necessarily just a sale,” Dorosz pointed out. “A sale is an outcome, but outcomes can mean things like brand preference, for example.”

The industry is changing and “working backward from the desired result.” At the moment, he said, “nobody is happy with measurement,” and that creates the opportunity for AI to enter the picture and create new solutions.

“So in the long term, I think we’re looking at something like media mix models.”

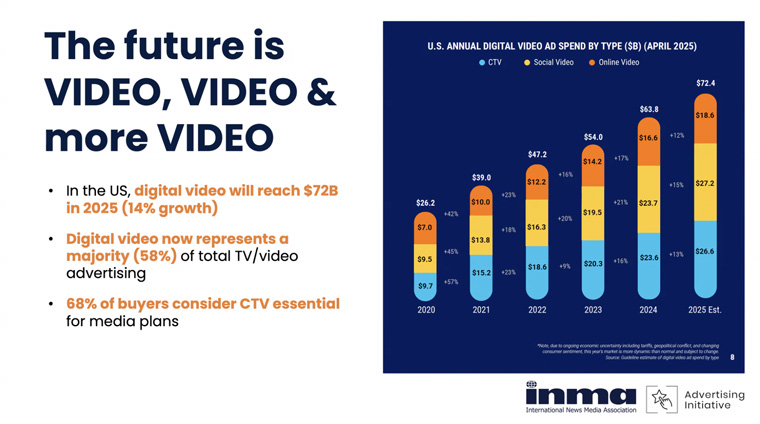

The rise of video

Another important trend for companies to embrace is the growth of video advertising. Dorosz shared data showing that by 2028, four of the top seven ad channels will be digital video formats. Short-form vertical video, in particular, is driving engagement and attracting advertiser spend.

“The future is video, video, and more video,” Dorosz said.

The format currently known as static display is becoming short-form video, and this year, 90% of all Internet traffic by volume will be short-form video. By 2028, 70% of display spend will flow to video formats.

“Our prediction — and publishers all over the world are landing on this sort of same conclusion — is six- to 10-second vertical video is going to become the new standard display format in app and Web,” Dorosz said.

It’s even showing up in non-mobile experiences such as newsletters and desktop interactions.

“There’s a gravitation to that format editorially and through advertising. So I strongly urge you to delve into this to start looking at short-form vertical video,” he added. “The way to win increasingly looks like short-form vertical video.”

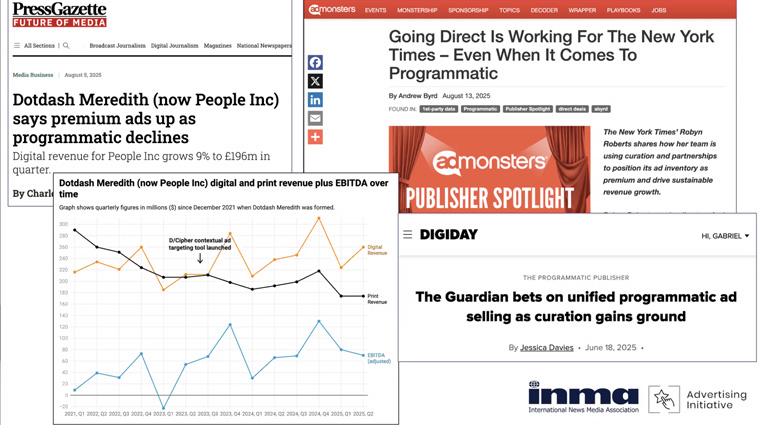

Programmatic and direct sales

Dorosz also addressed the evolving relationship between programmatic and direct sales. About 80% of digital advertising is now transacted globally, including 90% of U.S. digital display. And while global spending was approximately US$595 billion in 2024, this number is expected to increase to US$779 billion by 2028.

“The reason is, it’s easier for buyers to buy things programmatically,” he explained comparing it to the difference between mail order and e-commerce transactions.

The problem is, it hasn’t worked well financially for publishers. To get around that, he suggested reducing the middleman as much as possible and migrating inventory from the open marketplace into private deals.

“If you can do more direct deals, great. Direct programmatic and PMPs are pretty good in and of themselves for this,” he said.

Wilkinson asked if elite publishers like The New York Times are shifting toward programmatic, and Dorosz confirmed they are — but with strategy and safeguards.

“These rules apply to every publisher who is transacting programmatically,” he said. “So anyone who’s selling display — large, small, around the world — these are all strategies that everyone should be looking at employing.”

A framework for transformation

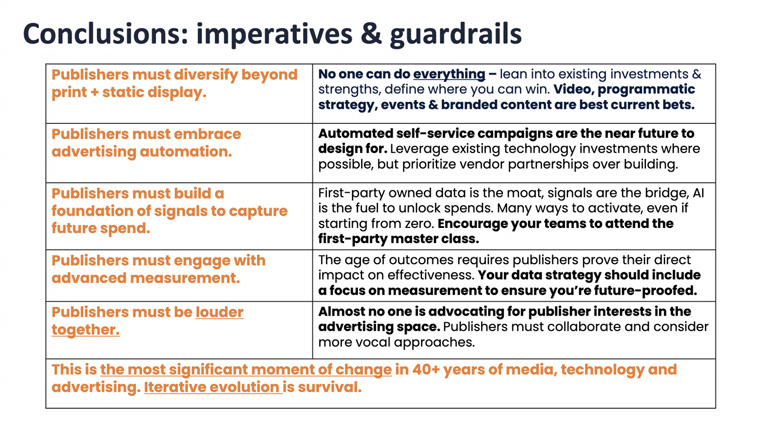

Dorosz offered a five-point framework for publishers navigating this historic season of change:

- Diversify beyond print and static display.

- Embrace advertising automation and smart experimentation.

- Build a foundation to capture future spend.

- Invest in advanced measurement capabilities.

- Collaborate and share insights.

Emphasising that this is the most significant moment of change for the industry, Dorosz conceded there are many unknowns, so publishers should look at the strategies that are winning.

“Iterative evolution is necessary for survival. Publishers can win, I believe, if they embrace these strategies and adapt them to their unique strengths.”