The importance of first-party data strategies for advertising

Advertising Initiative Blog | 07 September 2025

When I joined INMA and began designing the INMA Advertising Initiative mission and areas of focus back in May of this year, I had the privilege of conducting in-depth interviews with 12 INMA board members and news industry executives across diverse markets and presenting the findings to the INMA Board of Directors in New York.

As I said then, first-party data for advertising was the most mentioned and most imperative topic for news media advertising professionals.

One simple reason is the gap between opportunity and road maps: While 86% of publishers cite first-party data as their most significant asset for driving ad revenue, many still struggle to effectively monetise it.

And in fact the single biggest case for implementing first-party data strategies is the impact on revenue growth and diversification potential that results.

Why a first-party data strategy is so vital

Implementing a first-party data strategy for advertising can fundamentally change business economics across a number of metrics. News publishers implementing comprehensive audience data programmes achieve revenue increases ranging from 140% to 400%, with some seeing 5X improvements in campaign performance metrics.

According to Digiday, 71% of publishers now prioritise first-party data as their most significant revenue driver.

In other words, the reason this was the most discussed and most important topic in those first set of conversations with INMA advertising executives is that first-party data activation is the most significant revenue optimisation opportunity available to news media advertising in today’s challenging media landscape.

Understanding first-party and “zero-party” data for news publishers

Some of the terminology around first-party data activation strategies can be confusing.

When we (or I) talk about “first-party data,” we don’t just mean “logged-in” user data but any valuable data a publisher can gather from its audience and activate for advertising. This includes all of the classifications below:

- “Zero-party data” (usually just called “first-party data” in many markets like the United States) represents the highest-value information users explicitly share through newsletter subscriptions, preference centers, event registrations, and editorial surveys. News publishers excel at this type of data collection because readers willingly provide information in exchange for personalised news experiences, exclusive content access, and communication preferences. This explicit data provides unmatched quality for both advertising targeting and editorial strategy.

- Behavioural data encompasses article consumption patterns, video engagement, newsletter opens, social sharing behaviours, and cross-device reading habits. News publishers generate rich behavioural datasets through daily content consumption, enabling sophisticated audience modeling that reflects both current interests and evolving preferences. This behavioural depth creates advertising targeting opportunities often unavailable to other publisher categories.

- Demographic and geographic data voluntarily provided during registration or profile completion includes age ranges, income levels, job titles, company information, and location data that creates foundational audience understanding. News publishers particularly benefit from professional demographic data as their audiences often include business decision-makers, policy influencers, and industry experts willing to share professional information in exchange for relevant content.

- Contextual data includes article topics, content categories, breaking news consumption, opinion versus news preferences, and seasonal reading patterns. News publishers benefit from extensive contextual signals that provide targeting opportunities without personal identification, becoming increasingly valuable as privacy regulations expand.

- Declared interest data through topic preferences, notification settings, newsletter subscriptions, and event participation creates explicit audience segments for advertiser targeting. News readers frequently declare specific interests in politics, business, sports, technology, and other categories, enabling precise audience segmentation.

The cost of inaction

Publishers without first-party data strategies face accelerating disadvantages that ought to drive a sense of urgency:

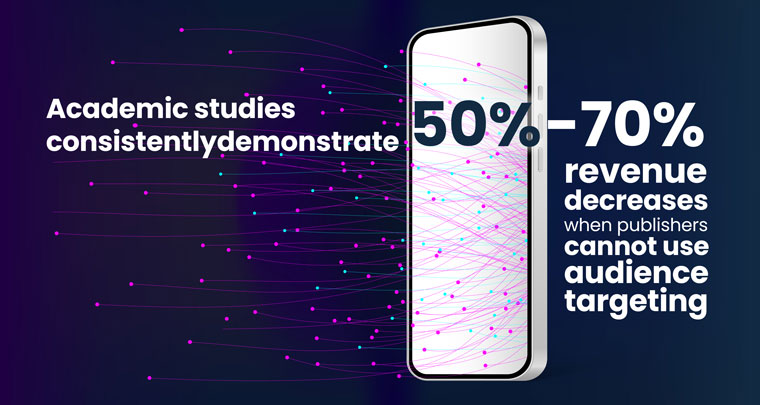

- The revenue penalty is documented and severe: Academic studies consistently demonstrate 50%-70% revenue decreases when publishers cannot use audience targeting. Google’s own research shows 52% publisher revenue decline without cookie-based targeting, while the UK Competition Authority found 70% revenue loss in cookieless environments.

- Open exchange dependency creates a problematic cycle: 55% of publishers rely on open exchanges to monetise cookieless inventory and admit they “don’t monetise cookieless inventory effectively.” This forces publishers into the lowest-value monetisation channels where inventory is treated as commodity-level without audience verification.

- Browser restrictions are already impacting revenue: Safari and Firefox block cookies by default, affecting 60%+ of traffic in some regions. News publishers serving this traffic experience revenue losses as programmatic buyers cannot efficiently bid on anonymous inventory, leading to dramatically lower CPM rates and reduced fill rates.

- Direct sales teams lose competitive edge: Without audience verification, sales teams rely on basic demographic assumptions rather than verified audience data, leading to generic inventory pricing instead of premium rates justified by professional audience quality that news publishers actually serve.

Advertising revenue decline occurs more rapidly because advertisers increasingly demand brand safety verification and audience quality assurance that only comprehensive data strategies provide reliably.

Subscription growth limitations prove particularly damaging since conversion depends heavily on demonstrating content value through reader engagement optimisation requiring sophisticated audience understanding.

Breaking news monetisation disadvantages emerge as competitors optimise advertising rates during high-traffic events while publishers without data capabilities cannot adjust pricing or targeting in real-time.

The competitive gap widens daily. Leading news organisations establish significant audience data advantages through proprietary segments, custom advertising formats, and measurement capabilities that competitors cannot replicate. The window for competitive differentiation continues narrowing.

If you’d like to subscribe to my bi-weekly newsletter, INMA members can do so here.